Arriello’s Sam Tomlinson reviews the findings of new US/EU research charting biotech efforts to expand their market globally.

The biotech market was estimated to be worth $1.55 trillion globally in 2023, and is due to grow at a compound annual rate of 13.96% between now and 2030[1]. Yet not all markets are equal; conditions are dynamic too. To delve deeper into biotech companies’ geographic strategy, and assess their changing perceptions against the experienced reality, Arriello recently commissioned a transatlantic survey among 200+ Regulatory, Safety and Quality Directors at small/medium biotechs, split 50/50 between the EU (Ireland) and North America (the US).

The companies polled already had a strong and well-balanced international presence, typically a blend of direct representation and indirect, via local partners. Direct representation is currently highest proportionally in Switzerland, followed by Norway and Austria, and lowest in Turkey, Mexico, Argentina, the Middle East, Japan, New Zealand, and France, where in-country partnerships are more common. In the US, where overall representation is highest (97% penetration), activity is split roughly 50/50 between direct and indirect. A similar ratio is reflected in the UK, where 87% of respondents cited an active presence.

Target markets

Looking at companies’ next priorities either for first-time entry or for active expansion, the survey revealed a consistent focus on the US, UK, and Canada in both categories – the US leading both as an immediate priority and of high interest in the near future.

The picture becomes more interesting when contrasting respondents’ current priorities versus their relative focus five years earlier (in 2019). Brexit has elevated the perceived importance of entering or expanding into the UK, so that it is at least as important a market as Canada now (where five years ago, Canada was a greater priority).

Brazil is now deemed an immediate priority, meanwhile, along with the Middle East which is also a strong interest for the near future. Five years ago, Brazil was sixth down the list (two places below Mexico, which no longer features as a priority target), while the Middle East did not feature as a top-10 market of interest.

The biotechnology market in Brazil is expected to reach revenues of over $69,140 million by 2030, if it achieves its forecast compound annual growth rate of 14.2% between now and then[2]. The country today accounts for the largest share of Latin America’s biotech market, which Grand View Research attributes partly to Brazil’s improving infrastructure and domestic biotech innovation.

The Middle East, which country by country is looking to reduce its dependence on oil as set out in a series of high-profile new economic national ‘visions’, has become a region of growing interest for life sciences, too. Saudi Arabia, for instance, is proposing possible market entry within as short a period as six weeks, as long as companies have the supporting infrastructure in place.

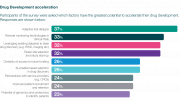

Barriers and green flags: perceptions versus reality

There is a general perception that it is still relatively complex and onerous to enter a new market, whatever efforts are in place to simplify processes. Respondents specified competition structure; political; and then legislative factors as the top three conditions for smoothing the way. By contrast, respondents ranked tax factors; resources/logistics; and cultural factors as contributing to a challenging experience.

When trying to enter new markets, respondents cited the following issues, in order of experienced negative impact:

- The scale/degree of quality-related challenges (e.g. required licences/authorisations; associated roles such as Qualified/Responsible Persons; and Quality Management System requirements)

- Pharmacovigilance-related infrastructure and expectations

- Significantly lengthier timescales to approval

- Substantially greater costs of market entry

- Failure to understand the specific requirements of the new market.

Asked which markets had presented substantial additional access issues, respondents most commonly cited China, followed by Brazil. US-based companies were more likely to be affected by higher-than-anticipated costs when new market access plans went awry. Over a third of companies (36%) withdrew from the opportunity altogether, not going on to enter the market.

Learning the hard way

Where companies had encountered difficult market access experiences, respondents put this down to a range of contributing factors. Key lessons learned included:

- That Regulatory and/or Quality experts need to be involved much earlier and more intrinsically in initial decision-making and planning around target markets

- That Pharmacovigilance experts need to be involved much earlier and more intrinsically in initial decision-making and planning around target markets

- That other markets should have been considered instead

- That the European opportunity has changed, in terms of which countries are optimal to target

- That market size alone does not determine revenue or profit success.

Measures of success in the biotech market

Finally, the survey identified an evolution in the measures of perceived success in biotech over the last five years. Reflecting on the gauges applied in 2019, respondents deemed these to have been revenue performance; followed by the number of patients reached – then profitability. Today, by contrast, divestment or investor payback are the main considerations.

The role of problem-free compliance has risen too. Getting products successfully past regulators is clearly a critical step in achieving a good return for the business and its stakeholders. Compliance performance is particularly pronounced as a measure of success for respondents in the US: 43% of survey respondents here cited this as a main measure of success today.

With pressures likely to worsen before there is significant progress towards global harmonisation of requirements (almost 40% of survey respondents expected accelerated routes to market to increase the pressure), ambitious biotechs will need to allow more time and apply more scrutiny as they fine-tune their global expansion plans.

About the research

Conducted independently by Censuswide in September 2024, the quantitative research polled 210 senior managers or directors in regulatory/safety/pharmacovigilance/quality roles at small/medium biotech companies in the US and Ireland (101 and 109 respondents respectively). The full report can be accessed here .

About the author

Sam Tomlinson is Vice President of Global Drug Safety at Arriello.

References

[1] Biotechnology Market Size, Share & Growth Report, 2030, Grand View Research: https://www.grandviewresearch.com/industry-analysis/biotechnology-market

[2] Brazil Biotechnology Market Size & Outlook, 2023-2030, Grand View Research: https://www.grandviewresearch.com/horizon/outlook/biotechnology-market/brazil